Overview of Brent Crude Reaching $85.43 per Barrel

Overview of Brent Crude Oil Prices

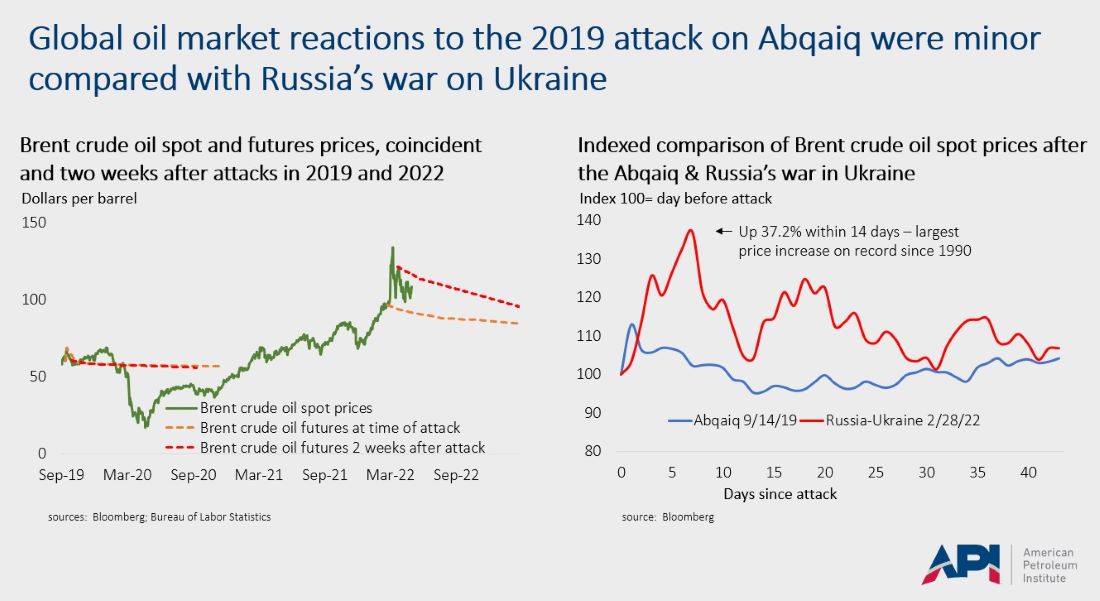

Brent crude oil, a major benchmark in the global oil market, carries significant weight in pricing for approximately two-thirds of the world's internationally traded crude oil supplies. Originating from the North Sea, Brent crude is renowned for its consistency in quality. Its pricing is heavily influenced by geopolitical factors, economic indicators, and production decisions by OPEC and non-OPEC nations. Historically, Brent crude prices have shown volatility, reflecting global economic health and supply-demand dynamics, now notably peaking at $85.43 per barrel, signaling potential economic shifts worldwide.

Effects of Brent Crude Price Increase on Global Economy

As Brent crude prices surge to $85.43 per barrel, the global economy experiences a ripple effect. Higher oil costs impact transportation and manufacturing sectors first, subsequently increasing consumer prices and inflation rates. Countries reliant on oil imports may face trade balance challenges, while oil-exporting nations could witness economic booms. This dynamic stresses the importance of energy policies, influencing everything from household budgets to international economic stability. The ramifications extend to various industries, highlighting the interconnected nature of global markets and economics.

Impact on Oil-Exporting Countries

Impact of Brent Crude Price Surge on Oil-Exporting Nations

The recent spike in Brent crude prices to $85.43 per barrel has profound implications for oil-exporting nations. Revenue for these countries typically increases, bolstering their national budgets and enabling greater investment in public projects and infrastructure. Enhanced fiscal stability can reduce sovereign debt and potentially spur economic growth. However, dependence on fluctuating oil prices also poses risks, as too much reliance on oil revenue can deter economic diversification. The prosperity from higher oil prices may also lead to inflationary pressures in domestic economies, underscoring the complex balance these nations must maintain.

Strategies of Oil-Exporting Countries in Response to Price Rise

With Brent crude prices climbing to $85.43 per barrel, oil-exporting countries are adopting varied strategies to capitalize on this surge. Several nations are focusing on stabilizing their economies by bolstering sovereign wealth funds to save surplus revenue for future economic downturns. Investment in diversification projects is another key strategy, aimed at reducing over-reliance on oil exports and fostering sustainable economic sectors such as technology and tourism. Additionally, some countries are increasing production to maximize immediate profits, while others may restrain output to maintain price stability. These strategic decisions highlight their efforts to ensure long-term economic health amidst volatile oil markets.

Implications for Oil-Importing Nations

Challenges Faced by Oil-Importing Countries with Increased Brent Crude Prices

As Brent crude prices reach $85.43 per barrel, oil-importing countries encounter significant challenges. Elevated oil prices inflate costs for transportation, manufacturing, and electricity generation, directly impacting consumer goods prices and contributing to heightened inflation rates. This can strain household finances and reduce discretionary spending, weakening overall economic growth. Additionally, trade deficits may widen as higher import costs offset export gains. Fiscal stability becomes a concern as governments may need to increase subsidies to buffer rising energy costs. Consequently, balancing economic policies to mitigate these repercussions while maintaining growth becomes a critical task for oil-importing nations.

Potential Solutions for Mitigating Effects on Oil-Importing Economies

Facing the impact of Brent crude prices at $85.43 per barrel, oil-importing economies are exploring various strategies to mitigate adverse effects. Energy diversification is a key approach, involving investment in renewable energy sources such as wind, solar, and bioenergy to reduce reliance on imported oil. Governments are also implementing energy efficiency programs to decrease overall consumption and enhance sustainability. Strategic petroleum reserves can be utilized to stabilize supply during price volatility periods. Additionally, enhancing regional cooperation and forming strategic partnerships with diverse oil suppliers can provide more stable pricing and supply contracts. These measures are crucial for ensuring economic resilience and maintaining growth amidst fluctuating oil prices.

Energy Market Trends and Forecasts

Trends in Energy Market Following Brent Crude Surge

In the wake of Brent crude reaching $85.43 per barrel, several notable trends are emerging within the energy market. The surge is catalyzing increased investment in renewable energy projects, as nations and companies seek alternatives to high-cost oil. Interestingly, technological advancements in energy storage and smart grids are gaining traction to maximize efficiency and integrate renewables more effectively. The market for electric vehicles (EVs) is expanding rapidly, driven by higher fuel prices and a push towards sustainability. Furthermore, traditional oil companies are diversifying their portfolios by investing in clean energy solutions to future-proof their businesses. These trends signify a transformative phase in the global energy landscape.

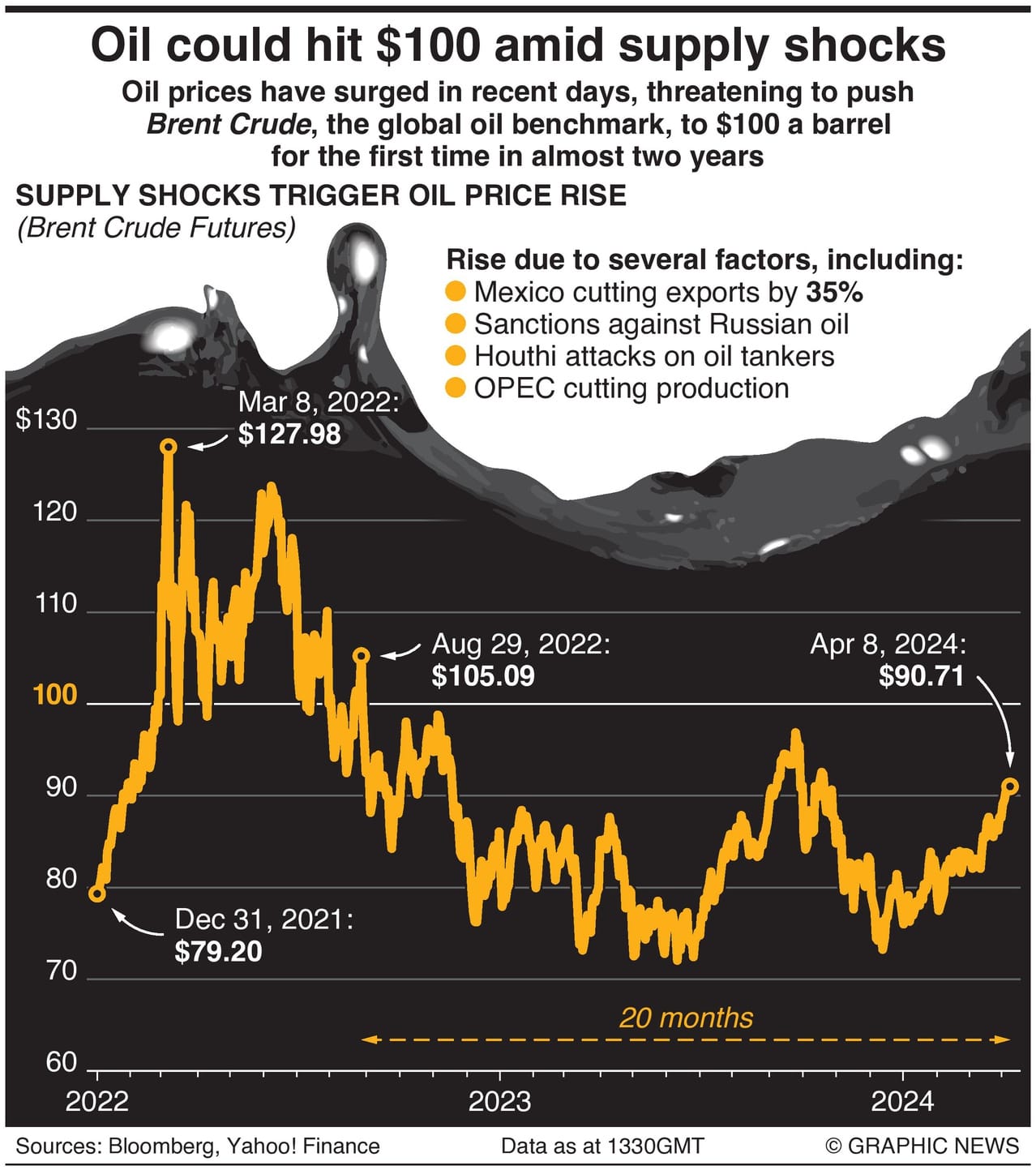

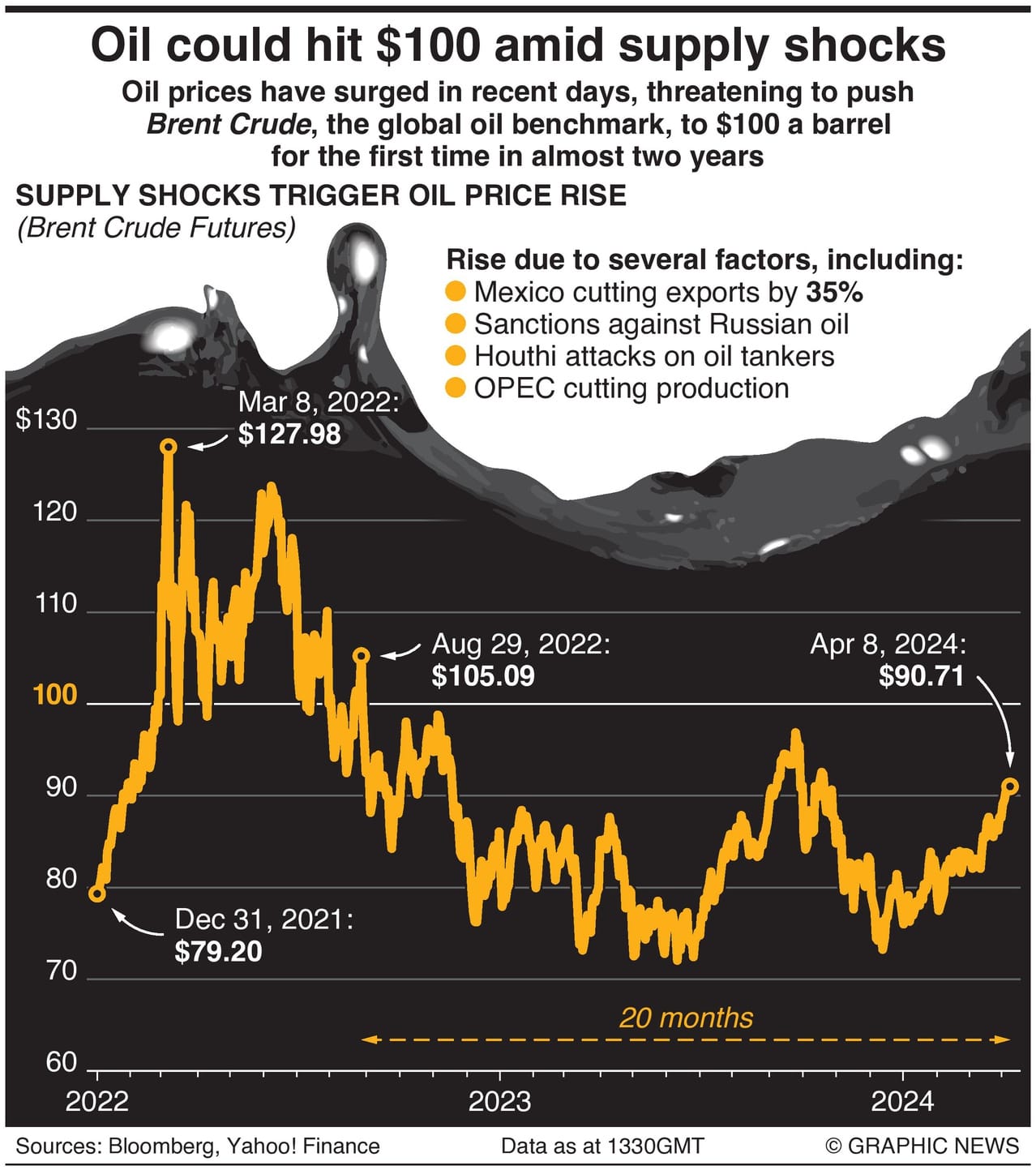

Forecasts for Future Brent Crude Price Movements

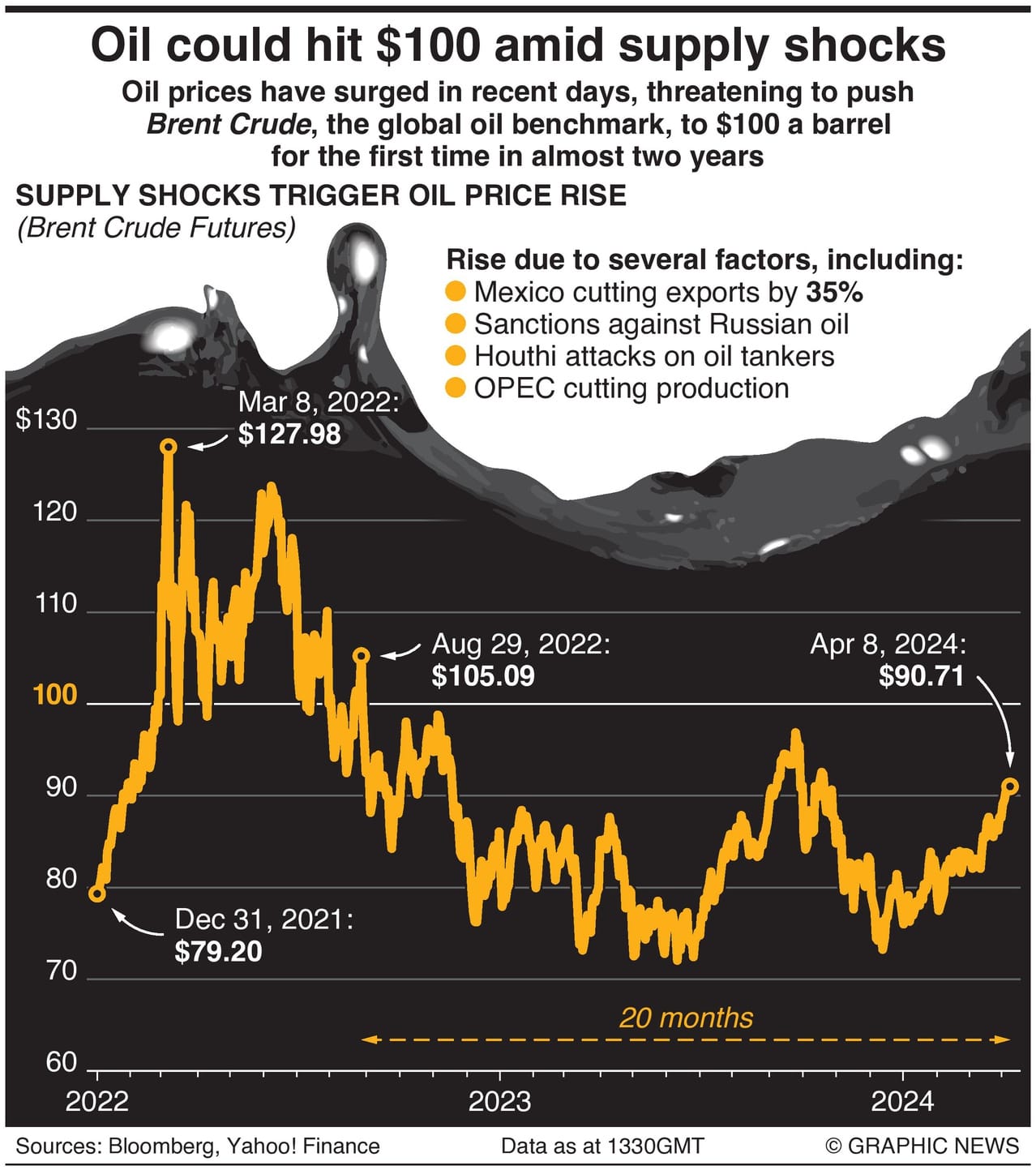

Following the surge to $85.43 per barrel, future Brent crude price movements remain a focal point for economists and market analysts. Predicting future prices involves analyzing a myriad of factors, including geopolitical tensions, OPEC policies, and global economic conditions. The shift towards renewable energy could temper long-term demand for crude oil, potentially stabilizing prices. Conversely, unexpected supply disruptions or increased global demand could drive prices higher. Some forecasts suggest prices may range between $80 and $100 per barrel in the near future, reflecting ongoing market volatility. Continuous monitoring of industry trends will be essential for stakeholders to navigate these fluctuations effectively.

Environmental and Political Ramifications

Environmental Consequences of High Brent Crude Prices

The surge in Brent crude prices to $85.43 per barrel has profound environmental implications. Higher oil prices serve as an economic incentive for nations and businesses to expedite the shift towards greener energy sources, thereby potentially lowering carbon emissions. This trend could amplify investments in sustainable technologies, fostering innovation in renewable energy sectors such as wind, solar, and bioenergy. However, a high oil price can also lead to increased exploitation of environmentally sensitive areas as countries seek to maximize oil output, potentially causing ecological damage. Balancing economic benefits with environmental protection thus becomes critical in mitigating adverse impacts while embracing sustainable energy practices.

Political Ramifications of Oil Price Fluctuations

Following the environmental consequences of high Brent crude prices, the political ramifications warrant close attention. Oil price fluctuations significantly impact international relations and domestic policies. High prices can strain relations between oil-importing and oil-exporting countries, leading to geopolitical tensions and strategic alliances. Governments in oil-exporting nations may experience increased revenue, strengthening their political power, while oil-importing countries face domestic discontent due to rising costs. Policy decisions around subsidies, taxation, and energy investments become politically charged, influencing election outcomes and administrative stability. Therefore, navigating oil price volatility requires astute political strategies to manage both domestic and international ramifications effectively.

Conclusion and Recommendations

Summary of Key Points

Building on the political ramifications of oil price fluctuations, a concise summary of key points consolidates our discussion. Brent crude reaching $85.43 per barrel has multifaceted effects on the global economy, oil-exporting, and oil-importing countries. For oil-exporting nations, increased revenue bolsters economic stability but underscores the importance of diversification. In contrast, oil-importing countries face inflation and trade deficits, prompting strategies focused on renewable energy and efficiency. The energy market is experiencing significant shifts towards sustainability, while future price movements hinge on geopolitical and economic factors. Additionally, environmental and political ramifications highlight the need for balanced economic and ecological policies.

Recommendations for Responses to Brent Crude Reaching $85.43 per Barrel

Building upon the summary of key points, tailored recommendations can effectively address Brent crude reaching $85.43 per barrel. For oil-exporting countries, continuing to invest in diversification projects is crucial to secure long-term economic stability. Establishing robust sovereign wealth funds can provide a safety net for future volatility. Oil-importing nations should prioritize energy efficiency programs and expand renewable energy investments to reduce dependency on imported oil. Strategic petroleum reserves can act as a buffer during periods of price instability. Furthermore, fostering international cooperation and negotiating more stable supply contracts with diverse oil suppliers will enhance resilience. Implementing these strategies will help navigate the complex challenges posed by fluctuating oil prices.